This document has been prepared by Daniel Bloom in his capacity as a shareholder of BUTA Limited, following his resignation from the Board on 20 January 2026.

It is a direct response to the Requisition of a General Meeting under section 303 of the Companies Act 2006, signed on 14 January 2026, which proposes two resolutions:

- Sale of residential flats and distribution of resulting profits

- Distributable reserves and dividends

The purpose of this paper is to set out why the proposed sale of company-owned flats, the distribution of sale proceeds, and the treatment of reserves and dividends are fundamentally unsound when assessed through the lens of long-term stewardship, financial resilience, and the interests of both current and future shareholders.

The analysis that follows is intended to assist shareholders in forming their own view ahead of the General Meeting. It is written from a shareholder perspective and does not rely on, disclose, or draw upon any confidential Board information. Nor does it speculate on motive or intent. Instead, it focuses on the structural, financial, and governance implications of the proposed resolutions and their irreversible consequences for the estate.

Executive Summary – Recommendation: VOTE NO

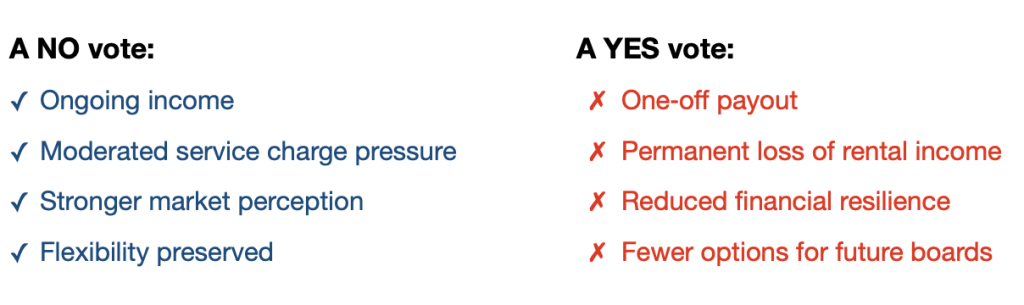

- Protect property values and saleability: Retaining the company‑owned flats preserves financial resilience that buyers and mortgage lenders increasingly expect.

- Avoid irreversible loss: Selling converts a long‑term, income‑producing estate asset into a one‑off payment that cannot be undone.

- Proportionality and process: A permanent sale of long-held estate assets merits careful scrutiny and long-term strategy, rather than a time-pressured decision.

- Preserve flexibility: A NO vote keeps multiple future options open – full sale later, partial sale, or continued retention – depending on market conditions.

- Strengthen risk protection: Rental income functions in practice as a reserve fund, reducing exposure to sudden per‑flat funding requests.

- Market timing is weak: London values, including NW3, remain below recent peaks; selling now risks locking in lower prices.

For shareholders focused on long‑term value, financial stability, and prudent stewardship, the balanced and defensible choice is to VOTE NO.

Stewardship of a Shared Legacy

In 1976, when the Church Commissioners intended to sell the entire estate, residents faced the loss of control over their homes and community. In response, tenants collectively purchased the freeholds, securing the estate’s long‑term future.

A core principle was established: every flat would hold one share in BUTA, whether or not the resident had contributed to the original purchase. This embedded fairness, collective ownership, and stewardship into the company’s foundations.

BUTA was not created as a short‑term investment vehicle, but as a long‑term steward of a unique residential estate. Decisions today should be assessed with the original purpose in mind.

What This Means for You as a Current Owner

The proposed sale does not only affect future residents. It directly impacts your property value, service charges, and ability to sell or remortgage.

Removing a material, recurring income stream increases financial volatility across the estate. Buyers and lenders increasingly scrutinise service charge levels, reserve strength, and exposure to major works. Estates without income buffers or adequate reserves are viewed as higher risk.

In practical terms, selling the flats would:

- Increase reliance on direct service charge demands

- Heighten the risk of sudden large bills for major works

- Make properties harder to sell and potentially depress values

Retaining the flats supports stability that benefits current owners today, not just future shareholders.

The Sale Is Irreversible and Weakens the Estate

The company‑owned flats are among the estate’s strongest long‑term assets. They generate substantial rental income each year, supporting the company and easing pressure on service charges.

Selling replaces this durable ongoing income with a single one‑off distribution. Once sold, both the assets and the income are gone permanently.

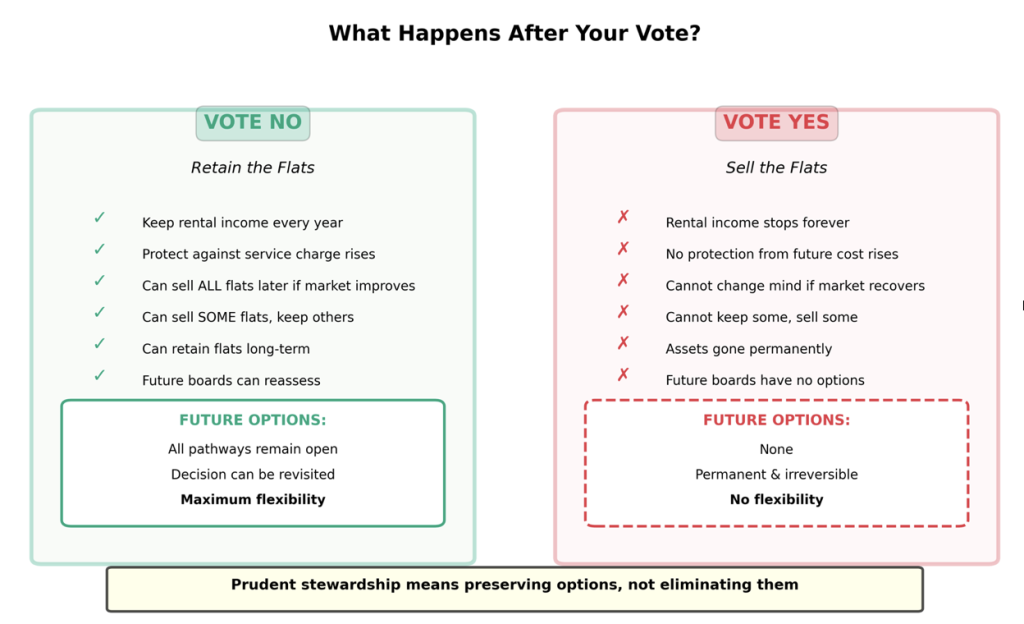

A NO vote preserves flexibility. Flats can always be sold later – in full or in part – if circumstances genuinely change. A YES vote removes that choice forever.

The implications of these two choices are materially different in practice.

These Assets Were Not Created by Shareholder Capital

The value of the company‑owned flats did not arise from additional shareholder investment. It accrued over time as protected tenancies passed away and properties reverted to the freeholder with vacant possession.

This makes the flats a collective estate asset generated through long‑term stewardship, not “locked shareholder cash”. Converting such an asset into a one‑time private payout weakens the company’s shared long‑term position.

One‑Off Cash Cannot Replace Long‑Term Income

Selling delivers one moment of financial benefit, with a high tax bill. Retaining delivers value year after year.

Once distributed, sale proceeds:

- Are spent, saved, or taxed individually

- No longer benefit the estate collectively

- Do not generate future income or service-charge relief

Keeping the flats ensures:

- Ongoing rental income

- Continued estate-level financial resilience

- The option to sell later, under better conditions – if needed

- The possibility to sell a smaller number if flats in the future is retained

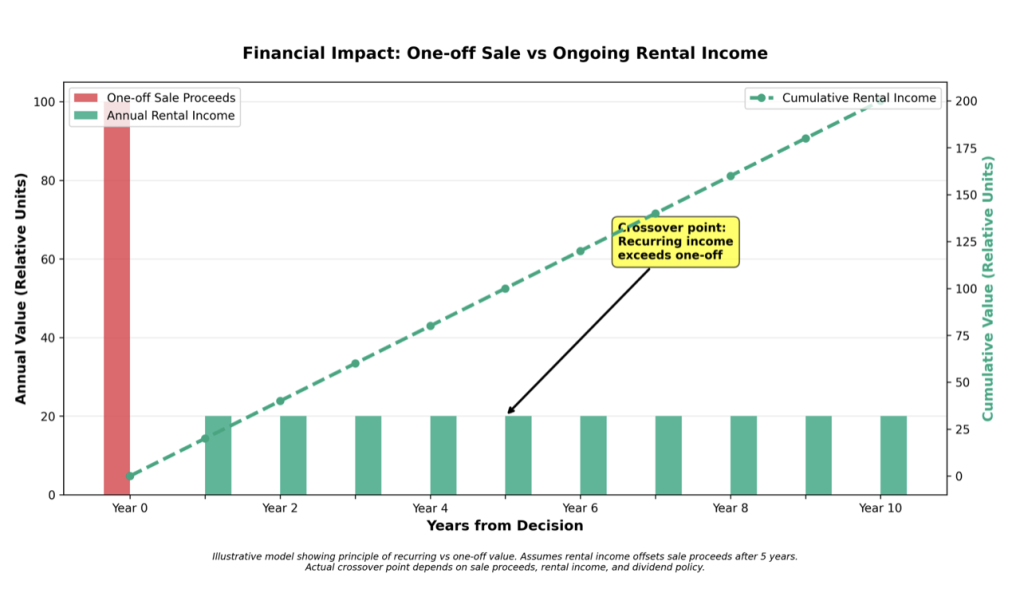

*Illustrative model showing principle of recurring vs one-off value. Assumes rental income offsets sale proceeds after 5 years. Actual crossover point depends on sale proceeds, rental income, and dividend policy.

The graph above illustrates a fundamental principle: whilst a sale delivers immediate value, recurring rental income accumulates over time.

Depending on actual sale proceeds and rental yields, the cumulative value of retained rental income typically exceeds a one-off payment within 5-7 years-and continues to grow thereafter.

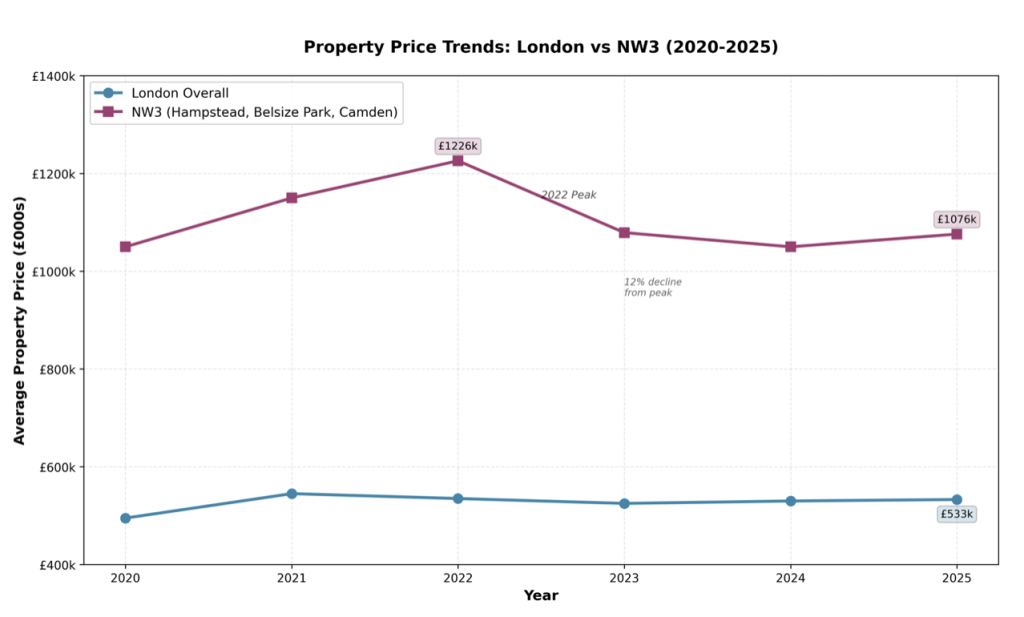

Market Timing Risk

London residential values have softened since their 2022 peak and have only recently stabilised. NW3 remains below prior highs.

Selling now risks crystallising lower values while transferring future upside to private buyers. Given the current market it is unlikely that the entire portfolio will sell within the twelve months without risk of selling at lower than market rates.

Retention allows shareholders to benefit from rental income while preserving the option to sell if market conditions improve.

Data shows a drop of 12.24% in property prices since the 2022 peek

*Source: HM Land Registry data via Office for National Statistics and Rightmove (December 2025)

By retaining the flats, shareholders keep:

- Rental income in the meantime

- The option to sell later if market conditions improve

- Protection against crystallising losses during a period of market weakness

Rental Income as Risk Protection (Reserve Fund Effect)

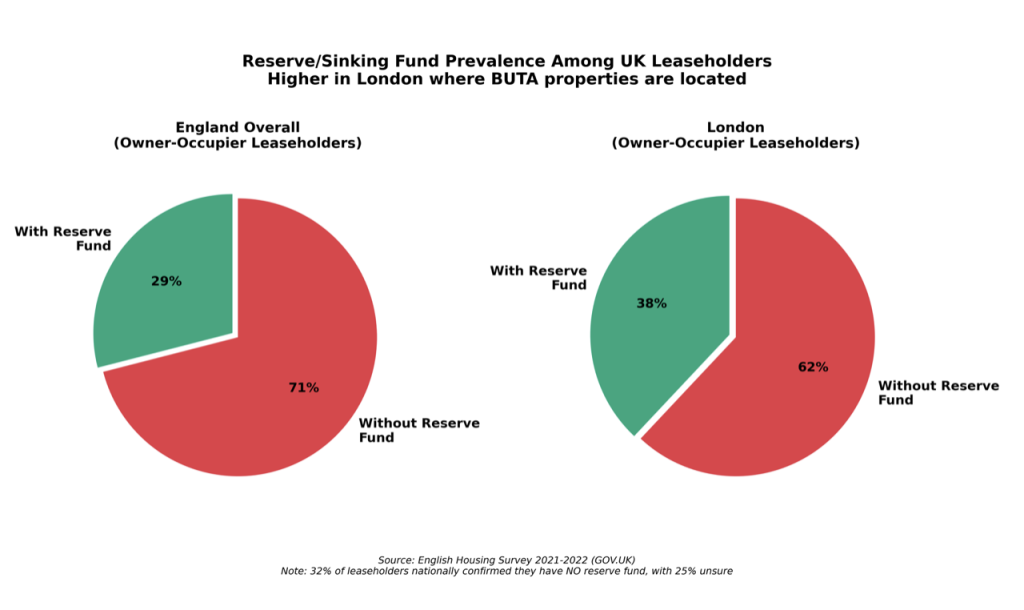

Reserve or sinking funds are standard in UK leasehold blocks and are increasingly expected by buyers and lenders. They exist to hold collective funds:

- Smooth service charge volatility

- Fund major works without sudden cash calls

- Demonstrate financial resilience

According to official government statistics, 38% of London leaseholders already pay into a reserve or sinking fund.

*Source: English Housing Survey 2021-2022 (GOV.UK)*

UK property management guidance recognises that adequate reserve or sinking funds make leasehold flats easier to sell.

The growing risks of climate change driven extreme weather that make financial reserves essential

Modern leasehold properties face escalating risks due to climate change that make reserve funds more important than ever:

- Climate-driven weather damage

- More frequent extreme weather events

- Flooding, storm damage, subsidence from drought

- Colder and wetter winters and drier, hotter summers are inevitable

- Insurance premium spikes

- Building insurance costs soaring

- Higher excess levels

- Some buildings becoming difficult to insure

English Housing Survey data (2021–2022) indicates that 57% of leaseholders either lack a reserve fund or are unsure one exists, a factor that heightens buyer and lender concern about major works risk.

In practice, buyers’ solicitors and mortgage lenders routinely enquire about reserve fund adequacy as part of leasehold due diligence, particularly where insurance costs and major works risk are elevated.

Traditional approach:

- Leaseholders pay sinking fund contributions

- Money sits in account waiting for major works

BUTA’s current approach:

- Rental income from company-owned flats provides cushion

- No additional sinking fund levy needed

- Income available when costs arise

- Flexibility to pay dividends OR retain for reserves

Functional Impact of Rental Income

- Whilst rental income is not a formal sinking fund held in a ring-fenced trust account, it provides equivalent financial resilience by creating an income buffer that can absorb cost shocks and moderate service charge volatility.

- In practice, the functional benefit to shareholders is similar: protection against sudden large bills.

- Where no such buffer exists, costs fall directly on leaseholders through immediate payment demands.

- This can create affordability pressure for some owners, make properties harder to sell, and increase concern among mortgage lenders.

Why Selling the Flats Removes This Safety Net

- Allows the company to absorb cost shocks without immediate leaseholder demands

- Demonstrates financial resilience to buyers and lenders

- Protects property values by signalling good governance

If BUTA sells the income-producing flats, this natural financial cushion disappears entirely. Any major event must then be funded by either:

- Immediate leaseholder cash calls

- External Borrowing (increasing long-term costs through interest)

- Deferred maintenance (leading to deterioration and higher eventual costs)

- Creation of a Sinking Fund or other structured reserve arrangementto mitigate risk

Each of these outcomes has financial and market consequences for shareholders.

Illustrative Cycle Following Asset Sale and Distribution

This diagram illustrates a potential financial cycle following the sale of income-producing flats. Sale proceeds are subject to taxation at the company level, with further tax potentially payable by shareholders depending on individual circumstances. Once distributed, the estate permanently loses its recurring income buffer. In the absence of that buffer, future major costs may require the creation of a sinking fund or other structured reserve arrangement(subject to lease provisions or variation), resulting in shareholders contributing funds back into the company over time.

Flexibility for the future: multiple pathways remain open

- Beyond today’s decision, the sale fundamentally alters the estate’s future options.

- A NO vote does not lock shareholders into permanent retention.

It preserves three distinct future options:

- Full sale when conditions improve – If property values recover to 2022 levels or beyond, shareholders could realise significantly higher proceeds

- Partial sale – The company could sell some flats whilst retaining others, balancing immediate benefit with ongoing income

- Long-term retention – Continue to benefit from rental income and service charge protection indefinitely

A YES vote eliminates all these options permanently.

Once sold, the assets and income are gone forever, regardless of future circumstances or shareholder needs.

This flexibility is not theoretical. Market conditions change, estate needs evolve, and future boards may face different challenges. Preserving options is prudent stewardship.

Rental Income Protects Against Rising Costs

Service charges across UK estates are rising faster than general inflation, driven by:

- Insurance premium spikes and higher excesses

- Construction and labour cost inflation

- Fire‑safety and regulatory compliance

- Climate‑related weather damage and repairs

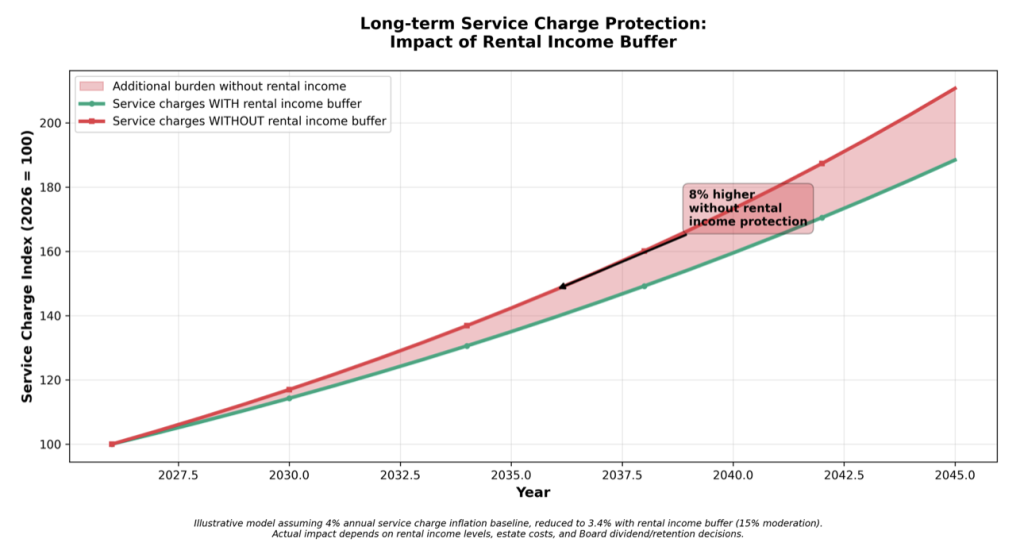

*Illustrative model assuming 4% annual service charge inflation baseline, reduced to 3.4% with rental income buffer (15% moderation). Actual impact depends on rental income levels, estate costs, and Board dividend/retention decisions.

The graph above projects the long-term impact of having-or not having-rental income to buffer service charge increases. Even a modest reduction in annual service charge inflation (from 4% to 3.4% in this example) compounds significantly over 20 years.

Having an independent, recurring income stream materially changes how these pressures are felt by shareholders.

With rental income:

- Cost increases can be absorbed or moderated at estate level

- Service charge rises are smoother and more predictable

- The estate is less exposed to sudden financial shocks

Without rental income:

- Every cost increase flows directly to leaseholders

- Service charge demands become higher and more volatile

- Financial risk shifts entirely onto individual owners

Even modest moderation of annual service charge increases compounds significantly over time, protecting affordability and reducing long‑term financial strain for shareholders.

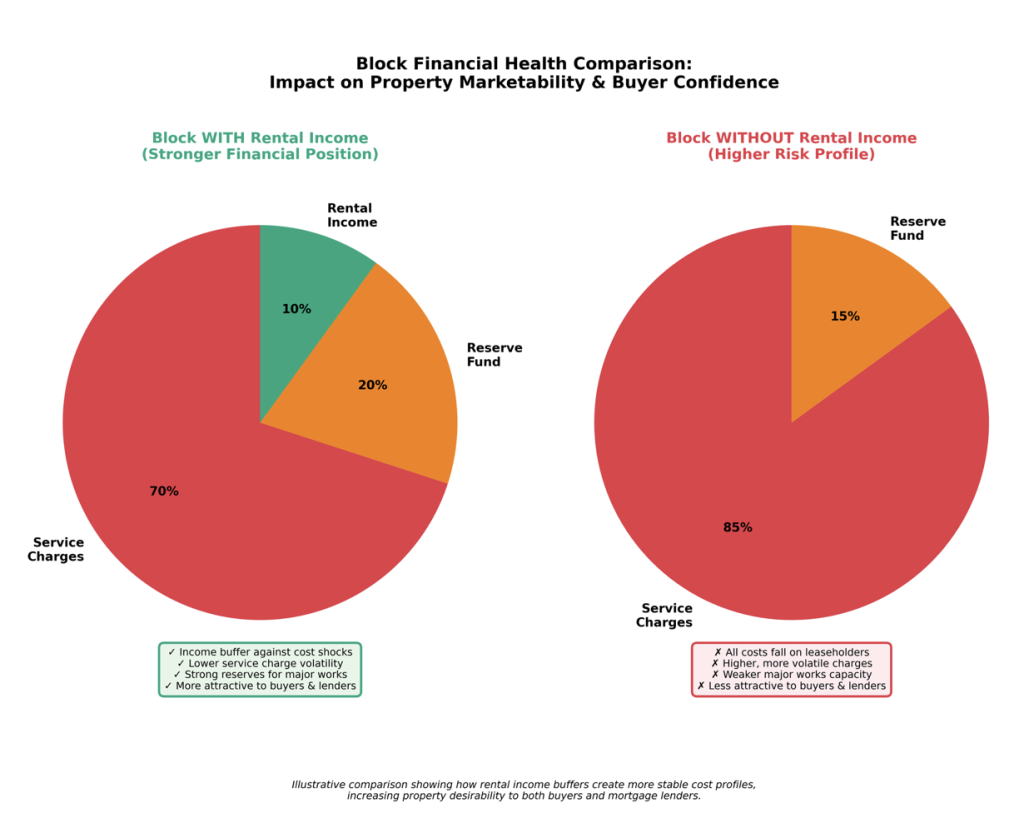

Selling Weakens Both Future and Current Owners – and Can Depress Property Values

It is a misconception that selling the company‑owned flats primarily affects future residents. The financial profile of the estate matters today.

Buyers and mortgage lenders increasingly scrutinise:

- Service charge levels and volatility

- Presence (or absence) of reserve funds or income buffers

- Exposure to major works and one‑off levies

Estates with diversified income streams and strong financial resilience are:

- Easier to sell

- More attractive to lenders

- Perceived as lower risk

Removing rental income pushes the estate in the opposite direction.

For current owners, this can mean:

- Longer selling times

- Price reductions to offset perceived risk

- Mortgage complications for buyers

In contrast, retaining rental income supports stability that directly underpins current property values and saleability, while also protecting future shareholders.

Financial profile comparison

*Illustrative comparison showing how rental income buffers create more stable cost profiles, increasing property desirability to both buyers and mortgage lenders.*

Protecting YOUR property value

Retaining the rental flats protects current shareholders in three ways:

- Maintains income buffer: Managed correctly, rental income can help absorb some cost increases, keeping service charges more stable and predictable

- Strengthens financial profile: Blocks with diversified income streams are viewed more favourably by buyers and lenders

- Preserves property values: Lower perceived risk translates to easier sales and better prices when shareholders wish to sell their flats

Summary Comparison

Appendix – Response to Common Arguments for Selling

Several arguments have been raised in favour of selling the company-owned flats. Below are responses to the most common:

Argument: “Capital is locked and should be released.”

The flats arose through long‑term stewardship, not shareholder capital injection. They are productive estate assets, not trapped cash.

Argument: “Selling benefits shareholders financially.”

Headline proceeds ignore sales costs, tax, and lost future income. Over time, retained income can match or exceed a one‑off payment while preserving protection and flexibility.

Argument: “Selling simplifies governance.”

The flats are professionally managed and generate net benefit. Reducing financial independence for the sake of simplicity is not sound governance.

Argument: “Current shareholders should prioritise themselves.”

BUTA’s structure was deliberately designed around continuity and fairness. Shareholders are stewards, not short‑term extractive investors.